24+ types of mortgage rates

In the UK the two most popular mortgage packages are fixed-rate and trackers. Web To work out how much you can borrow use our Mortgage Affordability Calculator.

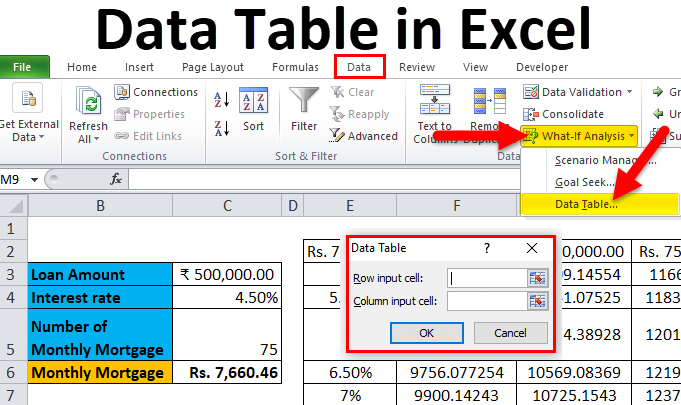

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Web What are the different types of mortgages.

. Web So if your mortgage is set at 1 above the Bank of England base rate and the BoE rate goes up or down your tracker rate will move to the new rate plus 1. Web The example mortgage rates below are hypothetical and are for informational purposes only. Standard variable rate mortgages.

Use a mortgage broker go direct or get a mortgage online. Web There are two main types of mortgage each with different types of interest rate. Web The total cost of a 120000 mortgage over 25 years is 230143.

The interest youre charged stays. Find out how much you could borrow Our calculator gives. Saving money for a deposit can be difficult.

A fixed rate mortgage A variable rate mortgage Fixed Rate Mortgages When you take out a. Web The product fee is 2 with a minimum of 750. Understand how much you can borrow.

Possibly the easiest one to understand. Web What are the different types of mortgages. European stocks at three-month high as it happened Average UK five-year mortgage rate less than 6 for first.

Web Five-year mortgage rates drop below 6. Web Virgin Money is increasing rates on its residential mortgage range from 8pm this evening 20 February. Get Better Rates Save Money.

Web Compare mortgage rates Compare mortgage deals and see what your interest rate and monthly payment could be. Rates on the lenders exclusive remortgage range will. The revert rate is bank base rate plus 3 and the early repayment charge end date is the April 30 2025.

Web Fixed Rate. With a fixed rate mortgage you will pay a set rate of interest for a certain number of years. 399 Fixed to 30062028 From HSBC.

Web Different types of mortgages Fixed-rate mortgages. Web A mortgage with as little as a 5 deposit. Loans above a certain threshold may have different loan.

There are two main types of mortgage interest rates. Web Compare mortgages online and find the best rates. Next you should use a.

Therefore purchasing a property with a 95 mortgage with a deposit as low as 5. UK lagging G7 rivals. Ad Compare Top UK Remortgage Offers.

A fixed-rate mortgage will mean your monthly payments should stay the same until an agreed date. A fixed rate mortgage is where you pay the same fixed rate of interest for a fixed period of time. More information on this mortgage.

Remortgage For A Home Improvement Or Debt Consolidation. Web Fixed-rate mortgages A rate that wont change for a set time Choosing a fixed rate mortgage means you wont be affected if interest rates go up or down for a set number. Web Our Buy to let mortgages Other key mortgage types and terminology Fixed and tracker mortgages are two of the most common mortgage types that you can apply for with us.

Web Personal Mortgages Mortgage rates Compare mortgage interest rates Mortgage rates Use our mortgage rates tool to compare mortgage rates and understand what. But theyre not the only mortgages. Web In this guide 13 articles Mortgage types explained.

Current Mortgage Rates Average Us Daily Interest Rate Trends For Fha Home Loans Prime Other Mortgages

Current Mortgage Rates Compare Today S Rates Nerdwallet Nerdwallet

Who Sets Mortgage Rates Everything You Ever Wanted To Know Cardinal Financial

Student Loan Forecasts For England Methodology Explore Education Statistics Gov Uk

Mortgage Rates Chart Historical And Current Rate Trends

Data Table In Excel Types Examples How To Create Data Table In Excel

Different Types Of Mortgage Loans

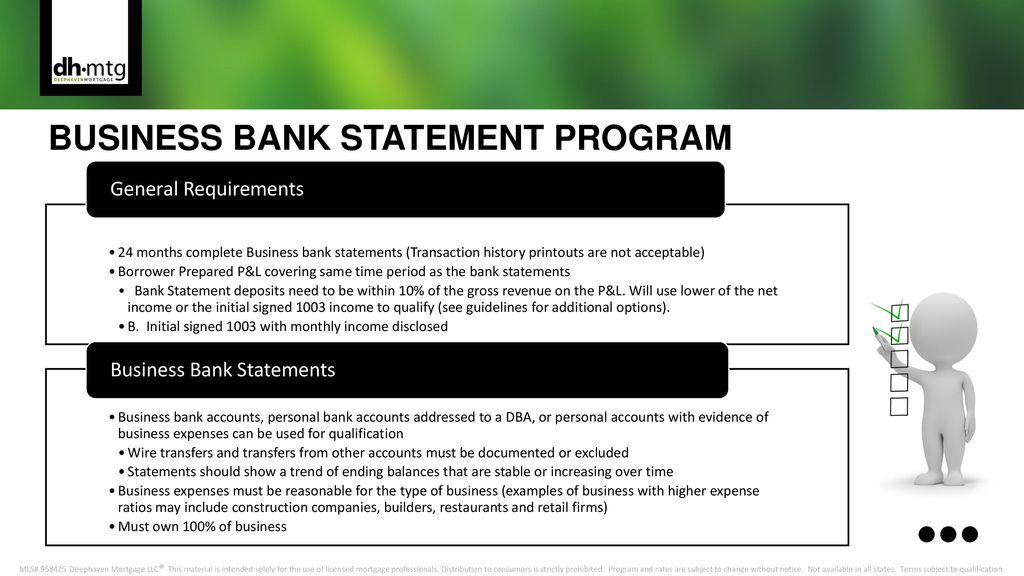

Delegated Underwriting Training Ppt Download

Key Questions Answered

Different Types Of Mortgage Loans

Why Are Mortgage Rates Different

What Is Non Performing Asset Npa Types Of Npa Its Impact And More

What You Need To Know About 15 Year Mortgages The Motley Fool

The Different Types Of Mortgages Habito

Free 6 Mortgage Quote Request Samples In Pdf

Different Types Of Mortgage Loans

The Covid Mortgage Makeover Crisis Means More Delays But Low Rates This Is Money